Agrifoods International Cooperative is quietly regaining its place as a leader amongst Canada’s co-operative

Every great story includes some sort of transformation — a fall from grace or return home. The story of Icarus is one of the most famous, of course. In a dramatic warning against hubris, Icarus builds a set of wings and attempts to fly to the sun. Nearing his goal, the wings melt, and he falls into the sea.

Like Icarus, the story of Agrifoods Cooperative includes a spectacular fall from height — a fire sale and revenues dropping overnight from $1.5 billion to a few million. But this once-mighty co-op has been making an impressive, if somewhat quiet, resurgence and reinvention, and is quickly returning to its position as one of Canada’s leading co-operatives.

Dairyland, the 80s, and Saturday morning cartoons

Like Saturday morning cartoons and a bowl of cereal, milk played a central role in the idyllic morning ritual for kids throughout the 80s — a fortifying start to whatever Goonies-type adventures awaited you that day.

Every morning for a good chunk of that tumultuous decade, I’d study the simple cow drawing on the side of a milk carton before heading out for the day. Besides the introduction of music videos and the Commodore 64, the 80s also took milk from being milk to something with a percentage — a reflection in the USDA’s shift to a pro-low-fat milk stance midway through the decade.

By the late 80s, low-fat alternatives began to outsell whole milk and the world made a shift towards “healthier” options and — thanks to some technological innovations in dairy production — a much larger variety of dairy products began hitting the market.

To add fuel to this changing landscape, a few global tariffs dropped in the 80s, opening opportunities for supplying and competing with multinational food and dairy companies. These were years of tremendous growth and change in the dairy industry.

For dairy co-ops, it was a time of mergers and acquisitions. In a landscape that included large multi-nationals, Agrifoods Cooperative was amongst those leading the pack in Canada. At the time, its best-known brand was Dairyland.

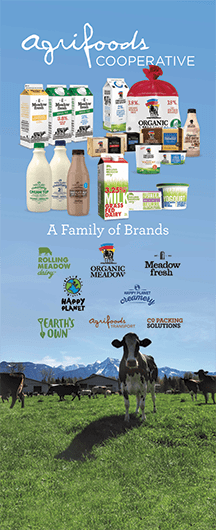

Today, Dairyland is a well-known household name across Canada and owned by global dairy and bakery conglomerate, Saputo. And Agrifoods’ new family of brands — Organic Meadow, Meadowfresh, Earth’s Own and Happy Planet — have become leaders in the health and wellness industry, producing a wide range of premium, on-trend, wholesome foods and beverages available across Canada. How this came about is a complex but compelling tale.

Early days and a series of mergers

The story of Agrifoods Cooperative gets its start in 1897. Within what is soon to become the province of Saskatchewan, a loosely organized group of creamery owners collaborates to save costs and market their product more effectively. Following the formation of Saskatchewan as a province in 1905, they soon formally register as the Saskatchewan Co-operative Creameries Association.

During this same timeframe, Fraser Valley Milk Producers, Northern Alberta Dairy Producers and Central Alberta Dairy Producers each do something similar in their regions. And every one of these associations produces its own products and corresponding brands.

For its part, Fraser Valley Milk producers creates two brands that quickly help it secure market share in southern British Columbia. One of these brands is Dairyland.

“Like many co-operatives, chaotic marketing conditions were behind the formation of the Fraser Valley Milk Producers Association,” writes Wendy Holm and Alan Robb in “OCFAID Analysis of the Demise of Canada’s Dairyland Co-operative” (2015). “By 1917, the new co-operative represented 90 percent of lower mainland dairy farmers.” For the next 70 years, the co-op is “healthy and vibrant,” adding processing plants capable of producing ice cream, cheese and powdered milk.

In 1972, Saskatchewan Co-operative Creameries Association merged with Dairy Pool to form Dairy Producers Co-op Ltd of Saskatchewan (DPCL). As a kid growing up in Regina during the early 80s, I only drank the milk this co-op provided — as far as I knew, there was no other kind. But competition was ramping up and the industry was beginning to make shifts.

In the early 90s, the Fraser Valley, Northern Alberta and Central Alberta co-ops recognize the need to merge and form Agrifoods International Cooperative, which operates under the corporate name Dairyworld Foods. Four years later, DPCL merges with Agrifoods and a Canadian dairy giant is born.

“It’s not easy (to survive) today in a market characterized by the growth and proliferation of new and traditional food companies, vertically integrated processing, increasing customer concentration and the growth of non-union cottage dairies,” said David Coe, Agrifoods Chief Executive Officer at the time of the merger in 1996.

This newly formed co-operative has 2100 dairy members in western Canada and becomes the largest dairy co-operative in the country. That same year sales reach $1.13 billion.

Related: Technology and the future of rural co-ops

Cracks in the seams

Strangely, it’s at this point things start to fall apart. In 1998, talks of a merger with Agropur fall through and major purchases meant to help cement Agrifoods position in eastern Canada hurt profitability due to amortized goodwill and debt financing linked to acquisitions.

Much of the story of dairy co-ops for a good portion of their first 100 years is measured success and carefully considered growth. Mergers and acquisitions often came as a slow response to broader political and economic forces.

But the mid-1980’s brings new technology and a reduction in global tariffs. Very quickly being both too big and too small is a serious problem for western Canada’s dairy co-ops.

On one side, global dairy giants are putting serious pressure on Canadian dairy co-ops to either scale through merger or get bought out. On the other side, small cottage dairies, which don’t have the upward pressure from unionized employees like the larger dairy co-ops, have more flexibility. The combination puts provincial dairy co-ops in a pinch.

Beyond competition, major purchasers, such as international food companies like Nestle and Unilever, demand consistent products across traditional jurisdictional lines.

Canada’s two largest dairy co-ops at the time, Agropur and Agrifoods, respond with aggressive growth through acquisitions and mergers. In 1993, these two Canadian dairy co-op giants even form Ultima Foods Ltd to combine their yogurt manufacturing and marketing in Canada.

For Agrifoods, the strain of this rapid growth is beginning to show. To gain strategic positions in eastern Canada, the co-op takes on large amounts of debt and amortized goodwill, which hurts cashflow. This growth also strains the co-op’s governance structure, which makes it hard to communicate to members how and why decisions are being made. The combination proves nearly fatal.

At the 2001 annual meeting, the board of Agrifoods at the time presents options that include bankruptcy or a fire sale of major chunks of its assets to one of the global dairy giants for 50 cents on the dollar. Not sure what else to do, members vote to sell and overnight Dairyland is erased from Agrifoods’ asset statement.

Rise of the Phoenix

Through all of this, Agrifoods manages to hang on to its transport and milk hauling service, as well as its joint venture with Agropur in Ultima Foods. A decade later, operating with a significantly reduced revenue stream — from $1.5 billion (2001) to $20 million (2011) — a dramatic re-invention and recovery is taking place.

In 2012, Agrifoods picks up top talent, Maheb Nathoo, as CEO and Ultima Foods launches ïogo. Both prove to be solid decisions. ïogo quickly becomes a household name across Canada. And, under Nathoo’s purposeful and strategic leadership, over the next four years Agrifoods makes a series of carefully picked and advantageous acquisitions.

Without a lot of fanfare, they purchase controlling interest in Meadowfresh Dairy, as well as Earth’s Own Food Company, which includes the SoGood, SoFresh and SoNice brands and processing processing facilities in both western and eastern Canada, and Happy Planet Foods.

The acquisitions cement the co-op’s position as a disruptive force, move them into central Canada and help them occupy more retail shelf space — all at the same time.

A pattern and strategy slowly emerge. Clearly, the leadership team is carving out a niche for the co-op and is targeting the fast-growing premium, health and wellness-focused markets.

Moreover, Agrifoods’ brands present a clear narrative of ‘locally produced and farmer friendly.’ Some innovative thinking is happening here about what it means to be a dairy co-op in the 21st Century.

Unlike traditional dairy, these brands are not afraid of demanding a higher price for the premium value they bring; and, in general, they target a younger demographic, which positions the co-op for long-term, high-value growth.

Great management also helps. Organic Meadow, for example, was in receivership when the co-op took it over. Today, it’s experiencing double-digit growth.

Amazingly, in just 5 years, Agrifoods under Nathoo’s leadership achieves 800% growth — increasing revenues from $20 million to $180 million in 2016 — and re-establishes itself as one of Canada’s leading co-operatives.

Related: RedHat Co-operative: a producer co-op success story

Returning to a leadership position

“When things are going well, it’s usually easy to get a group of people to join hands but the true challenge is when difficulties arise,” said Maheb Nathoo, CEO Agrifoods Cooperative. “Staying true to the co-op model, Agrifoods has weathered some incredible challenges yet through invaluable support, vision and tenacity, it has been able to create a new future, one of an exciting, sustainable organization which Members can pass on to generations to come.”

Not content with nationally recognized brands, and a successful foray into the Ontario market, in 2018 Agrifoods also extended its membership and a delegate position into Ontario, firmly establishing its place in the premium, value-added food processing world in Canada.

Now, instead of directly competing for market share with the large dairy multi-nationals, they focus on innovative, premium products with SKUs (product placement) not only in the dairy section alongside competitors, but also on grocery shelves and in the deli.

“We continuously look for ways to engage our consumers with more innovative products that give them variety, closer to the way nature intended,” Nathoo explained. “Our farm-to-table, ‘fable’, brands coupled with our micro-manufacturing capabilities enable us to be flexible and fill niche markets. We’re able to add fun, excitement, creativity — and positive disruption — to the product landscape while being progressive and sustainable which are all important to today’s consumer.”

With careful management and clear direction, the once Agrifoods Cooperative has picked itself up and is making solid strides towards greatness once again.